Welcome to to 2024! While time marches on, New York City Real Estate continues to stand the test of time despite occasional bumps in the road.

Is now the time to invest in Manhattan, Brooklyn or prime North Jersey Real Estate? Should I buy an Apartment in Midtown, a Townhouse in Bed Stuy or a multi-family and industrial property in North Jersey? Am I purchasing at the bottom of the market?

It’s no secret, prices are down and the leverage has shifted toward the buyers. The only question is how eager sellers are to negotiate their property. In some cases, deals can be made. In other circumstances, sellers have little debt on their property, are willing to ride out the market and have no alternative place to purchase if they do sell.

The New York Real Estate market will always remain a strong investment despite short term volatility. While the sales market has lagged during the past several years, rents have been at an all-time high creating a cushion for investors even while property values have temporarily decreased. In fact, the median price for a rental Apartment in Midtown is $5100 per month. All of this information makes this an opportune time to purchase in 2024.

5 Trends for 2024

- Be aggressive early. Buyers and Sellers want to make deals. The first six months of 2024 will be very telling for the marketplace. Don’t get married to a specific property. Pick out a bunch and put your best foot forward. Make sure it’s an area that will appreciate and see growth.

- Interest rates will remain at current levels. Historically, these rates are low, but unfortunately double the amount from two years ago.

- Invest for the Long Term. Property values will increase as soon as interest rates drop. You are purchasing at a built-in discount.

- Buy in the Right Areas. New York has seen an influx of migrants, homeless shelters and other unfavorable situations. Rents are still booming and demand is extremely high for a smart Apartment purchase or investment. Make certain the area you choose is one that will yield the long-term result.

- A Presidential Election. With the presidential election coming in November, buyers and sellers will be eager to make deals before the Fall. As the election nears, more uncertainty grows. Strike now while the iron is hot.

The key to a successful New Year with regard to a Real Estate purchase is to analyze and review many properties. Don’t be afraid to make offers and make certain the best team is lined up to successfully negotiate and close the transaction.

2023 Q3 Market Reports

As we begin 2024, let’s review and analyze data from the third quarter of 2023 Q3 according to the Douglas Elliman market reports. This will be very informational and a great starting point in order to analyze properties for the New Year.

2023 was another slow year for the Real Estate sales market in New York City with the rise of interest rates, inflation and economic uncertainty.

It’s interesting to note, the share of all cash buyers hit a new high in the 4th quarter of 2023. Cash buyers, typically the super wealthy, usually make up about half the market in Manhattan.

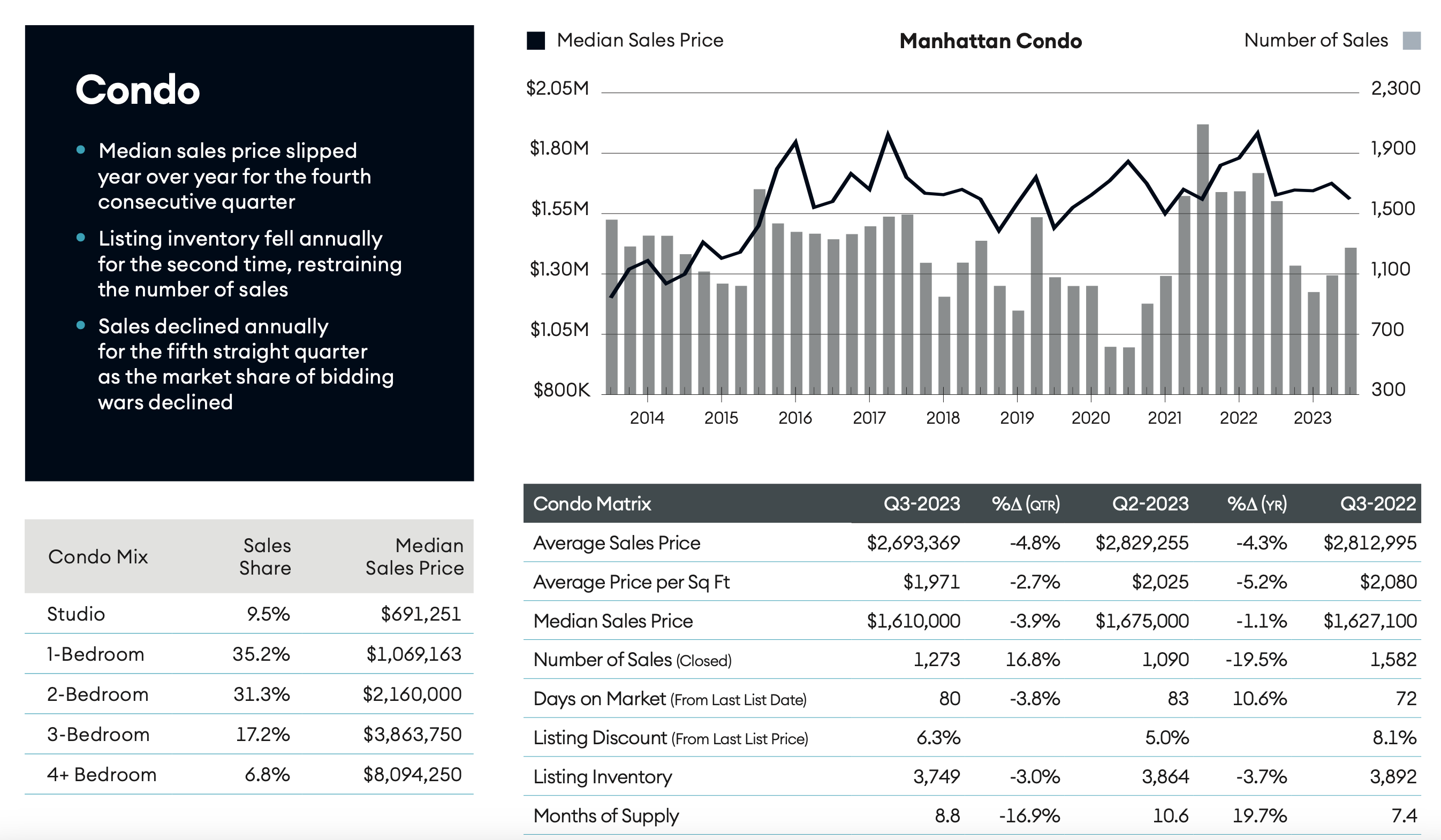

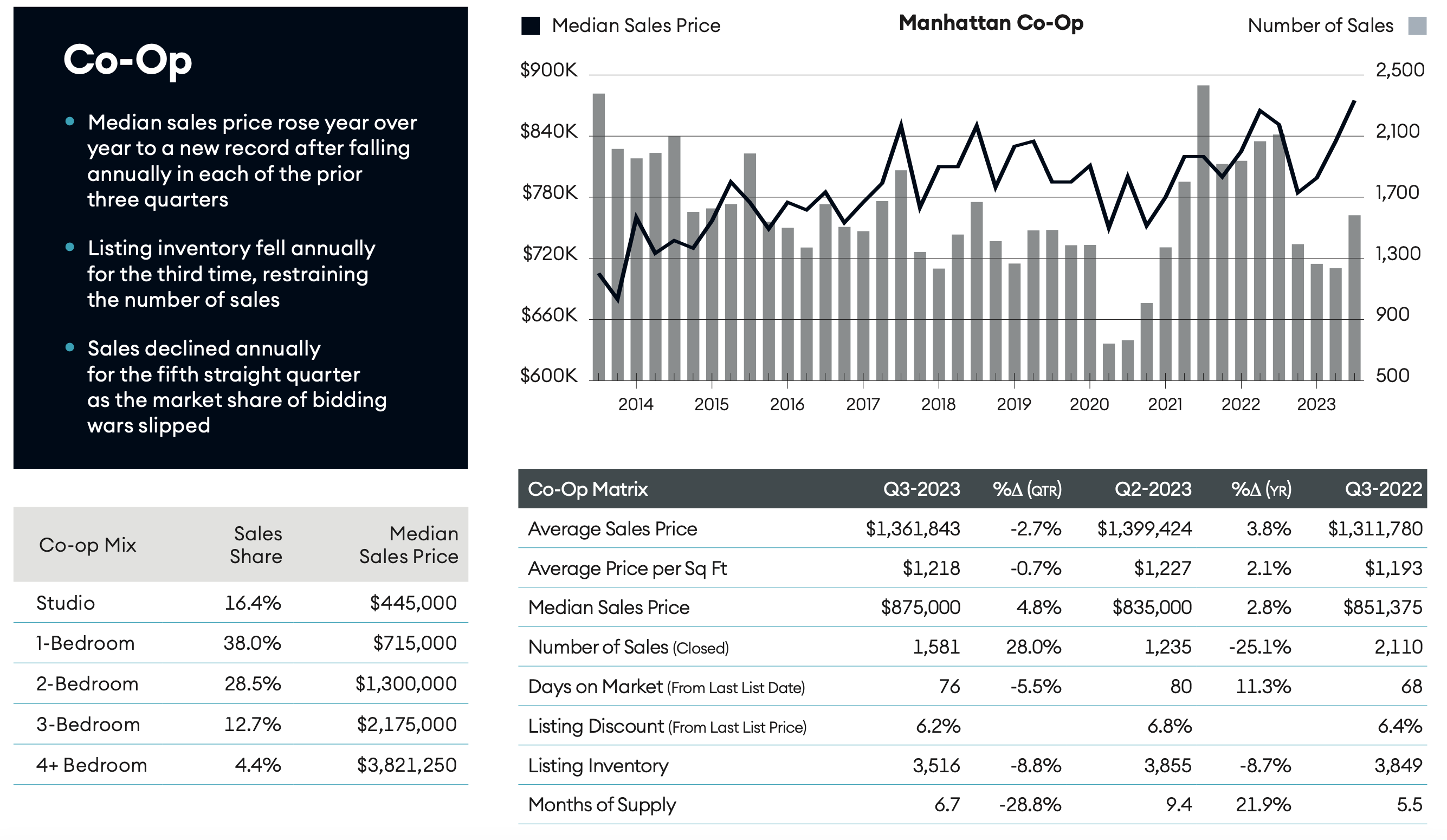

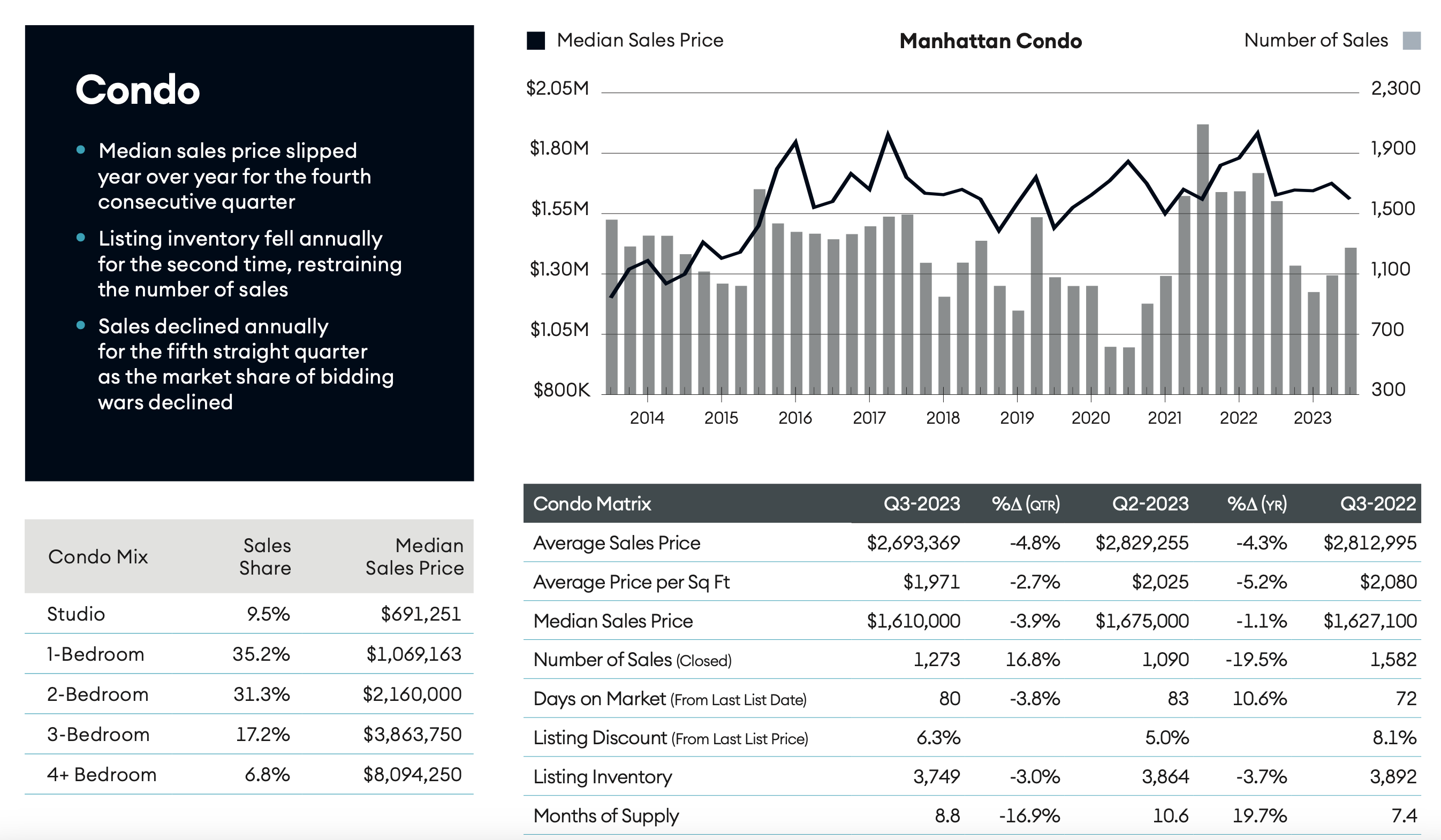

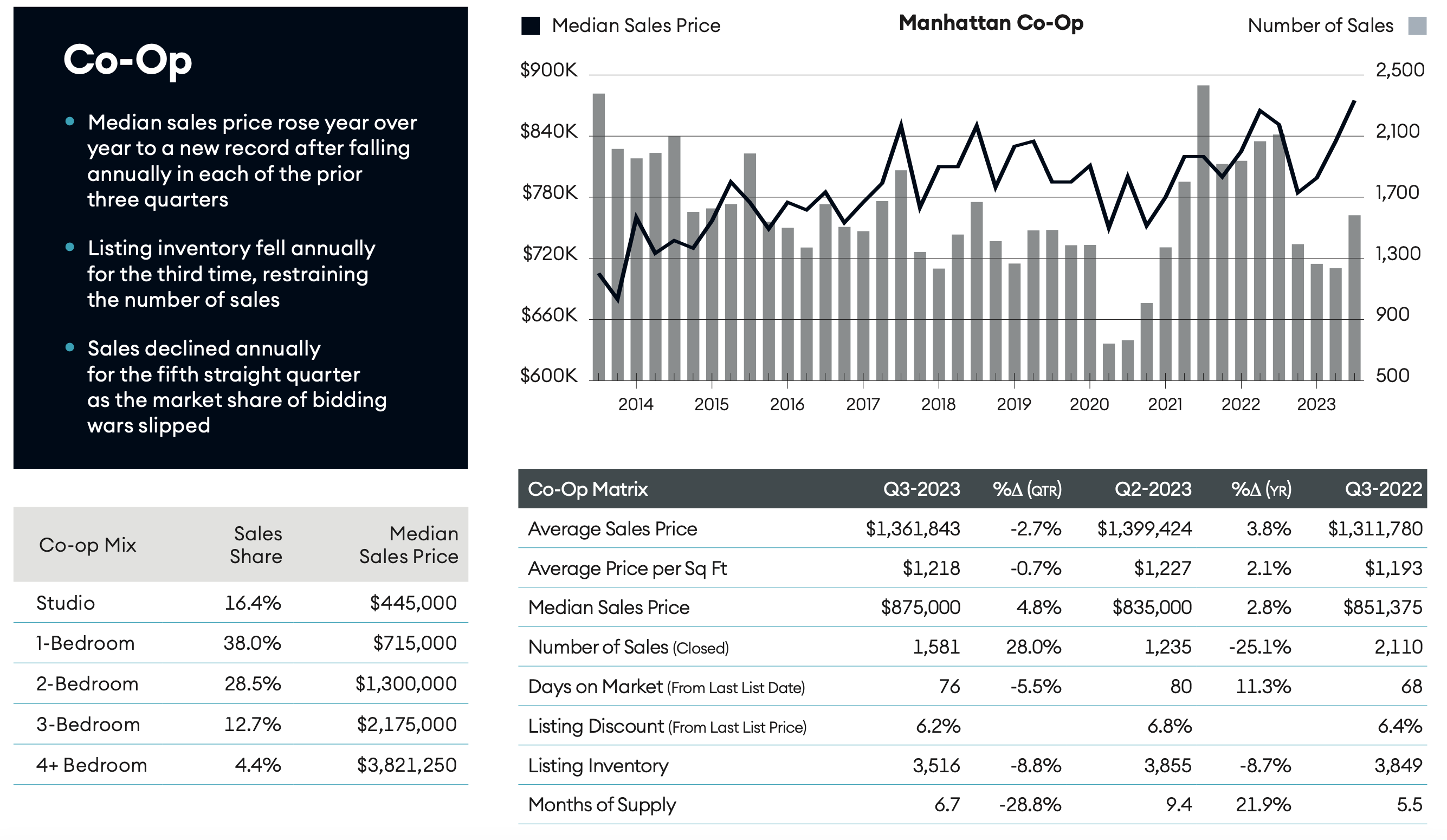

Condo & Co-Op Snapshot

These classic New York properties make up the lifeline of New York City Real Estate. The strength of these properties is the strongest sign of a healthy Real Estate market in Manhattan. This asset class has struggled during the past several years presenting opportunities to purchase at a good price. Statistics illustrate the following:

- -.4% Median sales price

- + 1.3 Months of Supply

- -22.7% closed sales

- -6.1% total inventory

- + 8 Days Marketing Time (Days on the Market)

- Median Sales price decreased annually at a diminishing rate for the fourth quarter but remained above pre-pandemic levels

- Sales declined year over year, likely the last quarter of distortion caused by the spike in mortgage rates

- Listing inventory declined annually for the second quarter as would be sellers remained wedded to their existing low mortgage rate

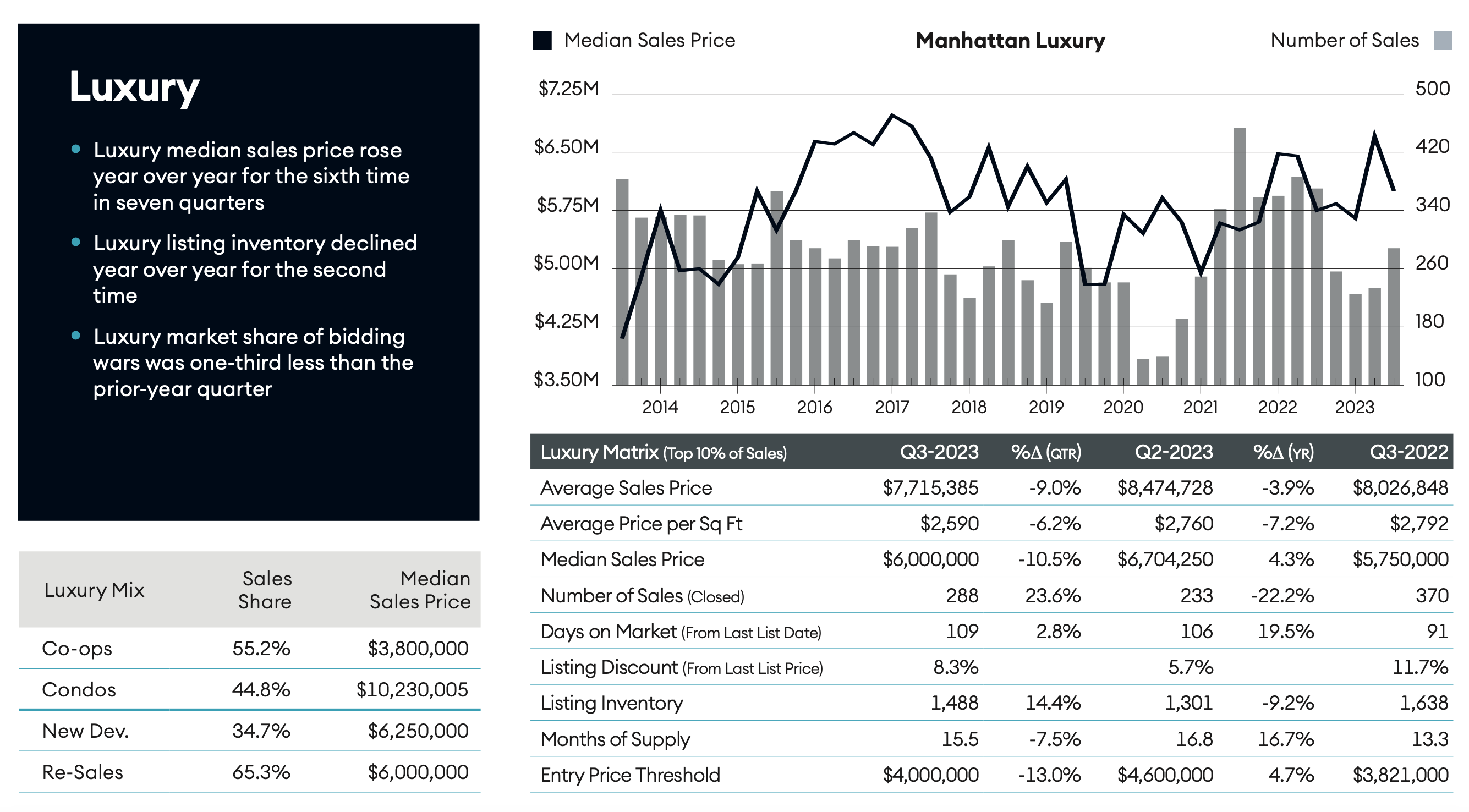

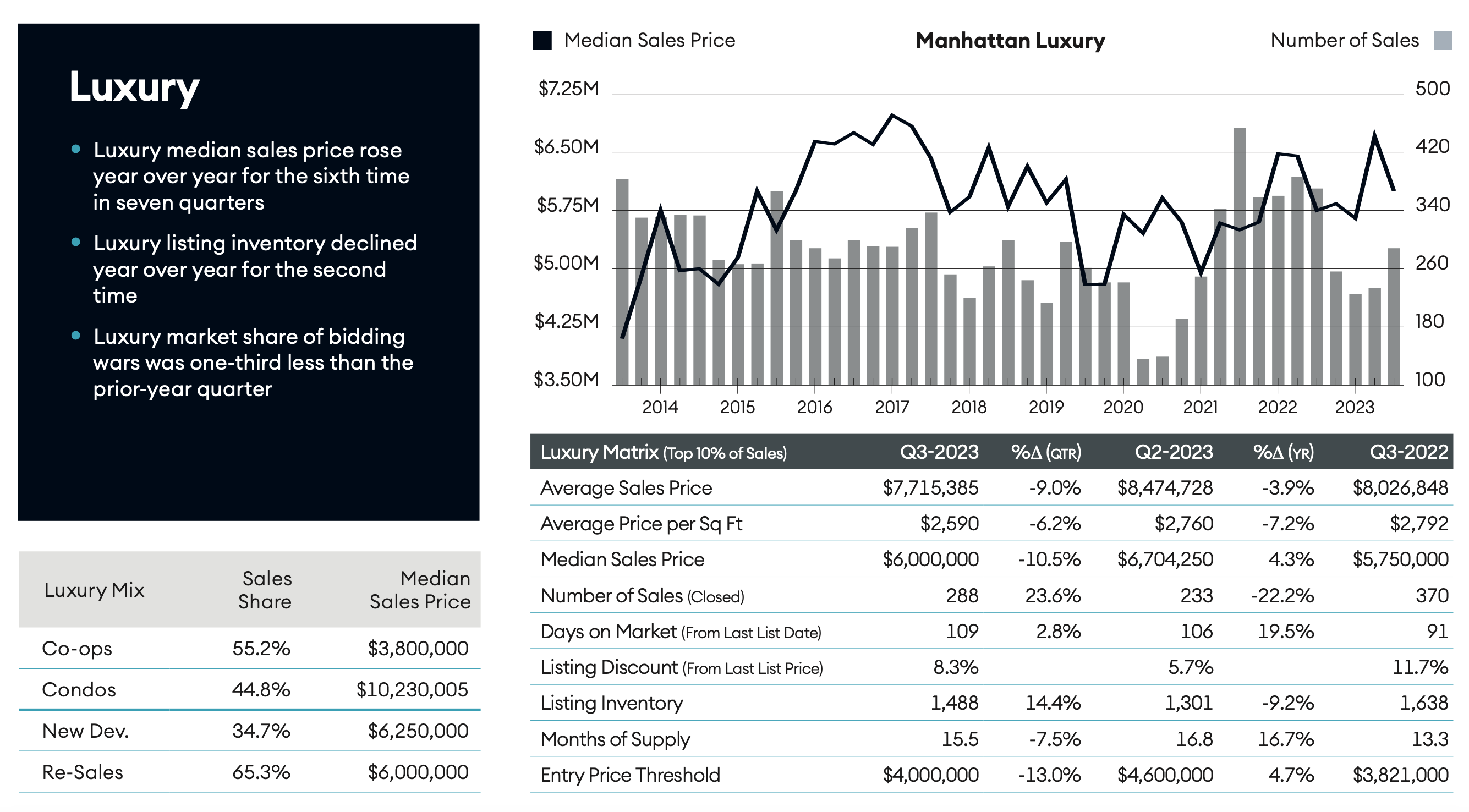

Luxury Sales Statistics

High net worth individuals make up a smaller slice of the marketplace, but typically drive up the median price of sales throughout Manhattan. These buyers typically pay all cash and don’t borrow money unless rates are very cheap. On a positive note, the luxury market has picked up, although the sales numbers are still at a large discount compared to pre-pandemic. The Elliman Report shows the following:

- Luxury median sales price rose year over year for the sixth time in seven quarters

- Luxury listing inventory declined year over year for the second time

- Luxury market share of bidding was one-third less than the prior year quarter

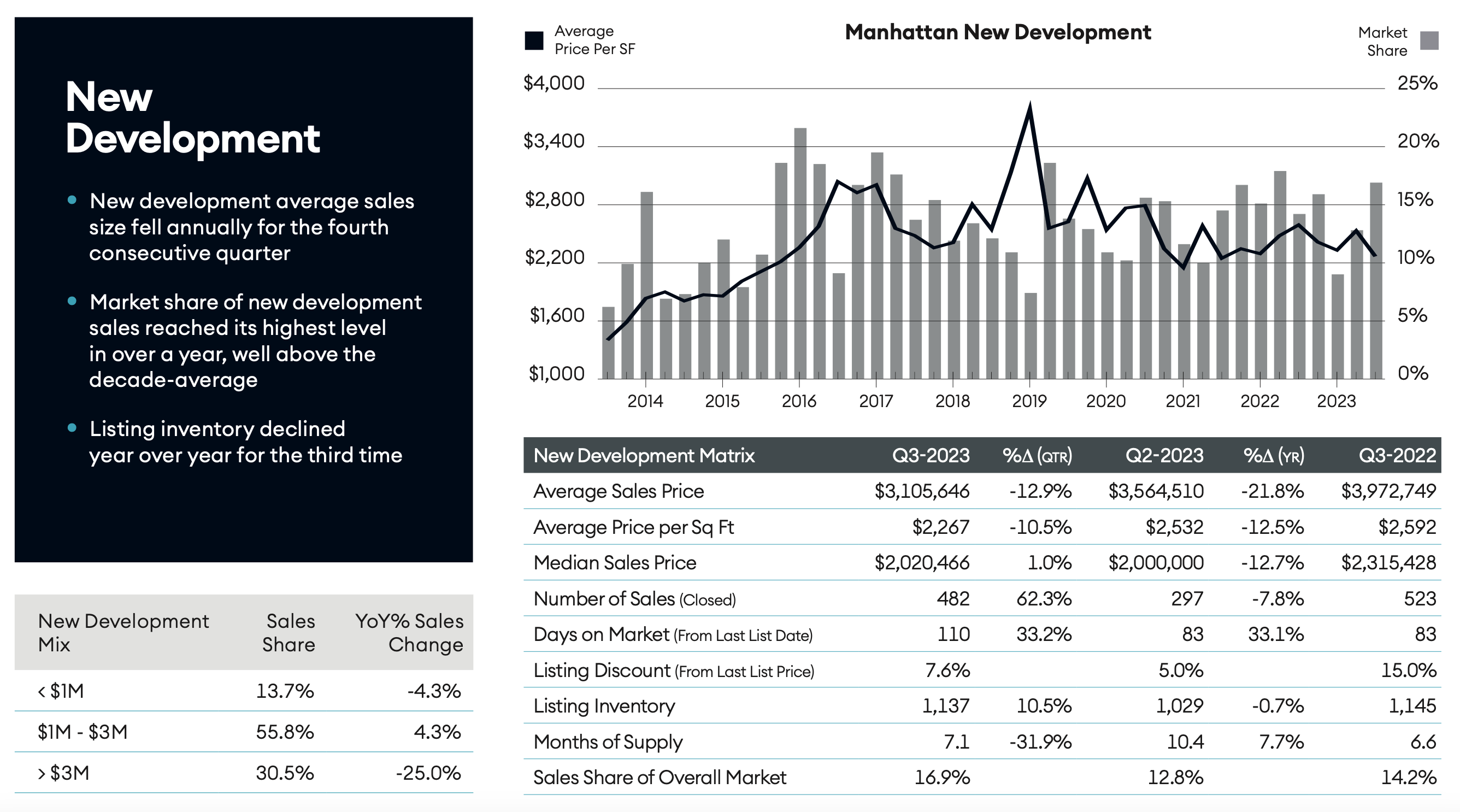

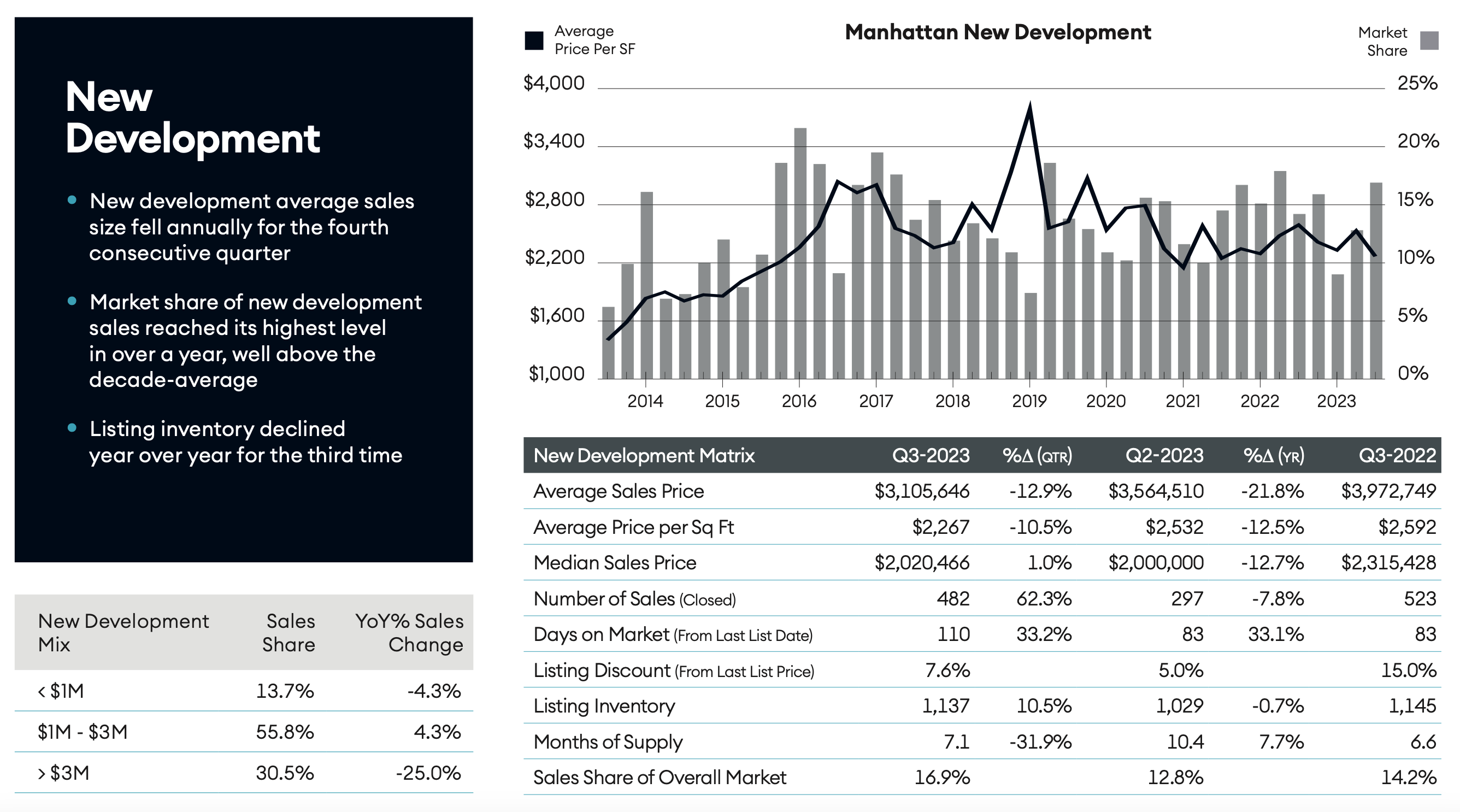

New Construction Development Sales

This data is a very big indicator of the marketplace. Typically, new Construction sells quickly and is able to obtain a very high price. If these sales stall, it means the cost of land in the future will need to decrease to compensate for the loss of sales revenue. Interest on money is high and construction is expensive. There will need to be compromises from buyers and sellers to make the numbers work at least for the smaller developers. The information shows the following:

- New development average sales fell annually for the fourth consecutive quarter

- Market share of new development sales reaches its highest level in over a year, well above the decade average

- Listing inventory declined year over year for the third time

Lets Make Some Deals

Down cycles in the Real Estate market only present every so often in ones lifetime. Analysts predict a Real Estate cycle typically occurs every seven years. There are many factors as to the reasoning, but if you have an investors mindset, don’t sit back and miss the opportunities. Lets be aggressive and make some deals together!